The ever-present threat of phishing scams is a risk that exists in today’s digital world where information is easier to get a hold of. Just like many other forms of fraud, phishing scams are deceptive schemes designed to trick individuals into revealing sensitive personal or financial information. Cybercriminals use various tactics to mimic legitimate financial institutions, all with the goal to compromise your security and steal your money.

In this blog post, we'll explore what phishing scams are, the common signs of phishing scams, how to differentiate between legitimate emails and phishing emails, and the steps to take if you suspect you've received one.

What is a Phishing Scam?

A phishing scam is a fraudulent attempt to obtain confidential information such as usernames, passwords, credit card details, and more. Just like the real sport of fishing, fraudsters are trying to reel you into their trap. The scam typically occurs via email, but it can also happen through other means, such as text messages or phone calls. These malicious messages often appear to be from trusted sources, like your bank, credit union, government agencies, or well-known companies, in an attempt to deceive the recipient into taking an action that benefits the scammer.

Common Signs of a Phishing Scam

As with all fraud, being educated is the first step to really understanding how to prevent phishing. To protect yourself from phishing scams, it's crucial to be aware of common signs that can help you identify fraudulent messages such as:

Generic Greetings: Phishing emails often use generic greetings like "Dear Customer" instead of addressing you by name. Legitimate institutions usually personalize their messages to make them more authentic and trustworthy. By using your name in the greeting, they show that they have your specific information and are not just sending out mass emails.

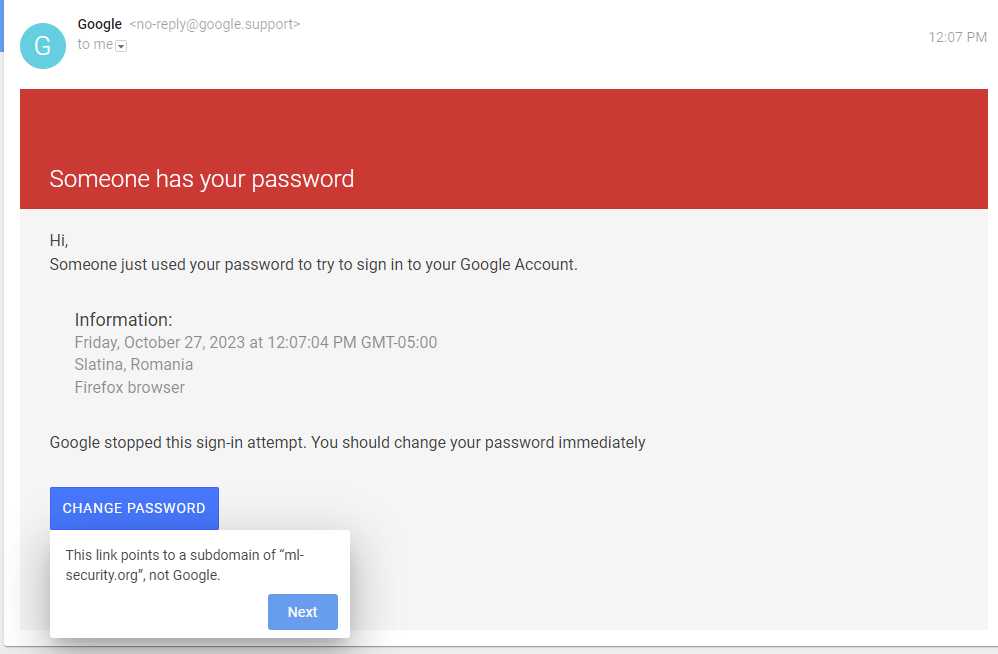

Urgent Language: Scammers create a sense of urgency by using phrases like "Your account will be suspended" or "Immediate action required." They hope to pressure you into acting without thinking. It is important to remember that legitimate financial institutions will never threaten you with immediate consequences or rush you into making a decision. Take a moment to step back, assess the situation, and verify the information before taking any action.

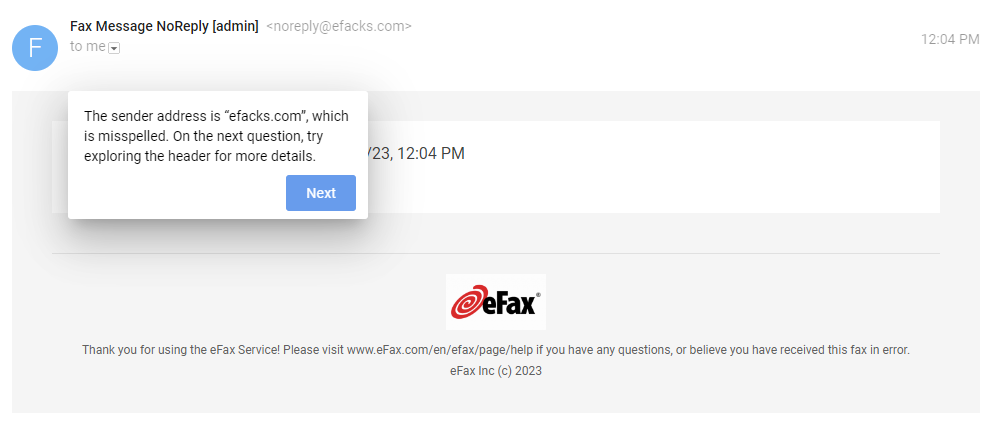

Mismatched URLs: Check the web address in the email, like the example below. If it doesn't match the official website of the institution, it's a red flag. Be especially cautious of URLs that use misspelled variations of legitimate websites. Fraudsters often create websites that look identical to the real ones, but the URLs may have slight differences. Always double-check the URL before providing any personal or financial information.

Spelling and Grammar Errors: Phishing emails often contain spelling and grammar mistakes. Professional organizations typically review and edit their communications for accuracy. If you notice consistent errors in an email, it's likely a phishing attempt. Legitimate financial institutions have strict quality control measures in place to ensure their communications are error-free.

Unsolicited Attachments or Links: Avoid clicking on attachments or links in emails from unknown or unexpected sources. Hover your mouse over links to preview the destination URL without actually clicking on it. If the link seems suspicious or leads to a website that you are unfamiliar with, it's best to avoid clicking on it altogether. Scammers often use attachments or links to install malware or direct you to fake websites where they can collect your personal information.

Requests for Personal Information: Legitimate institutions will never ask for sensitive information, like your Social Security number or full credit card details, via email. They have secure channels for collecting such information and will usually ask you to provide it in person or through their official website. If you receive an email asking for personal information, it's a major red flag. Always err on the side of caution and never provide sensitive information through email.

By being aware of these common signs of phishing scams, you can better protect yourself from falling victim to these deceptive schemes. Remember, it's essential to verify the authenticity of any communication that asks for personal or financial information. Your security and peace of mind should always be a top priority.

How Can You Differentiate Between Legitimate and Phishing Emails?

Differentiating between legitimate emails from financial institutions and phishing emails can be challenging, as scammers have become increasingly sophisticated. However, there are several additional tips and techniques that can help you verify the authenticity of an email and protect your accounts from phishing scams.

One effective method is to carefully examine the sender's email address. Legitimate financial institutions typically use official domain names in their email addresses. For example, if you receive an email supposedly from your bank or credit union, but the sender's email address ends with a different domain name or contains unusual characters, it's likely a phishing attempt. Always double-check the sender's email address for any inconsistencies before taking any action.

Another important step is to contact the institution directly if you're uncertain about an email's legitimacy. Instead of relying solely on the information provided in the suspicious email, use contact information from the official website of your bank or credit union. Look for their official phone number or email address and reach out to their customer support or security team to verify the message's authenticity. This way, you can get accurate information directly from the institution and avoid falling into the trap of scammers.

In addition, enabling multi-factor authentication for your accounts can significantly enhance your security. Multi-factor authentication adds an extra layer of protection by requiring additional verification steps, such as entering a code sent to your phone or using biometric data, along with your password. By enabling this feature, even if scammers manage to obtain your login credentials through a phishing attempt, they would still need the additional verification factor to gain access to your accounts.

It's crucial to ensure that your passwords are strong and unique. Use a combination of uppercase and lowercase letters, numbers, and special characters to create strong passwords. Avoid using easily guessable information, such as your name or birthdate, and never reuse passwords across multiple accounts. Changing your passwords regularly can also help minimize the risk of unauthorized access.

What To Do If You Suspect a Phishing Email

If you suspect that you've received a phishing email, follow these steps to protect yourself and report the incident:

1. Do Not Click on Links: Avoid clicking on any links or downloading attachments from the suspicious email.

2. Forward the Email: Forward the email to your financial institution's official customer support or security team.

3. Delete the Email: Remove the email from your inbox, trash, and any other folders.

4. Run a Security Scan: Ensure that your computer or device has up-to-date antivirus and anti-malware software, and run a full system scan.

5. Change Your Passwords: If you've entered your login credentials on a suspicious site, change your passwords immediately, and monitor your accounts for any unusual activity.

Educate Yourself and Avoid Phishing Scams with Leaders Credit Union

Protecting your finances and personal information is essential in today's interconnected world. By staying vigilant, recognizing the signs of phishing scams, and knowing how to respond when you encounter fraud, you can safeguard your financial well-being and online security.

Leaders Credit Union is committed to helping you protect your finances, and we're here to support you whether by educating you or by helping you if you are caught by a phishing scam. Stay safe and remember that awareness and education is your best defense against phishing scams. That’s why we’ve created the Ultimate Fraud Prevention Help Kit. Download our guide so you can stay one step ahead of scammers and safeguard your finances.

Report Scams to the FTC

If you were scammed or think you saw a scam, report it to the Federal Trade Commission.