When it comes to managing your finances, there are several options available to you. Two of the most common options are credit unions and traditional banks. While both financial institutions offer similar services, there are some key differences between the two.

Let’s explore the differences between credit unions and banks to help you make an informed decision about which one is right for you.

What is a Credit Union?

A credit union is a not-for-profit organization owned and operated by its members. Each member of a credit union owns an equal share of the credit union. Members pull their money together to offer loans and other financial services to each other at competitive rates. Credit unions are often community-based. In addition to helping individual members, they also serve specific groups of people, such as employees of a particular company or residents of a specific geographic area. There are many membership benefits to banking with a credit union.

What is a Bank?

A bank, on the other hand, is a for-profit institution that offers a wide range of financial services, including savings accounts, checking accounts, loans, and credit cards. Banks are typically larger than credit unions and are often publicly traded companies with shareholders.

What are the differences between credit unions and banks?

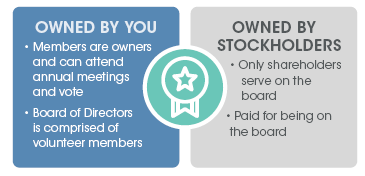

Owned by You vs. Owned by Stockholders

Credit Unions are owned by their members. Members vote and attend annual meeting. Credit unions also has a voluntary non-paid Board of Directors that meets monthly to provide oversight for the credit union.

Banks are owned by stockholders. These stockholders serve on the board and are paid for their contributions.

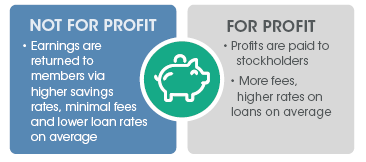

Not-For-Profit vs. For-Profit

Credit Unions are not-for-profit. They take their earnings and return them to members via higher savings rates, minimal fees and lower loan rates on average.

Banks use the profits they make to pay stockholders. They also tend to average more fees and higher rates on loans.

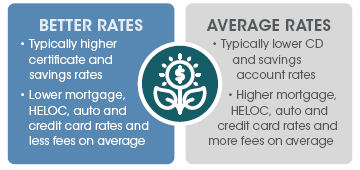

Better Rates vs. Average Rates

Credit Unions typically have better rates which include certificates and saving rates. They are also able to offer lower mortgage, HELOC, auto and credit card rates and less fees on average.

Banks typically offer lower CD and saving account rates. In addition, banks tend to have higher mortgage, HELOC, auto and credit card rates and more fees on average.

NCUA vs. FDIC

The NCUA is how credit unions insure individuals of their money in case of an incident. As a federally insured credit union, all member-owners have the peace of mind of knowing that they won’t risk losing any money with us. If your credit union is federally insured, your money is protected up to $250,000 per structured account.

Similar to the NCUA, banks are insured by the FDIC, protecting a customers' money up to $250,000 per structured account.

What are similarities of credit unions and banks?

Both banks and credit unions are insured by federal agencies to protect their depositors. Banks are insured by the Federal Deposit Insurance Corporation (FDIC), while credit unions are insured by the National Credit Union Administration (NCUA). This means your money is safe and secure, up to certain limits, regardless of whether you choose a bank or a credit union.

You might be wondering what the key differences between the FDIC and NCUSIF are. In many ways, they operate in the same way and provide the same service.

The FDIC was founded in 1933, not long after the start of the Great Depression. At the beginning of the Depression, many banks failed, and depositors lost their money. The FDIC was instituted to provide financial stability and protection for Americans. It began providing insurance in 1934, and since its inception, no depositor has lost insured funds due to a bank failure.

The NCUSIF was first funded without the use of government-provided money. It provides a minimum of $250,000 in total coverage to every member of federally insured credit unions. Specifically, it provides the following:

- Insurance for individual accounts up to $250,000

- Protection for each member’s interest in all joint accounts up to $250,000

- Separate protection for IRA and KEOGH retirement accounts up to $250,000

The NCUSIF is backed by the full-faith and credit of the United States. Since its inception, no federally insured credit union member has lost a penny of their money.

Said another way, the FDIC and the NCUSIF protect depositors’ money by insuring it if a bank or credit union fails.

What is an advantage of choosing a credit union over a bank?

One main advantage is that credit unions share their resources to invest back into their members through typically better rates, lower fees, and upgraded technology. Credit unions are also more likely to work with you if you have less-than-perfect credit, and they may offer more personalized service than banks. Additionally, credit unions are owned by their members, which means that members vote on important decisions such as changes to the credit union's bylaws, the election of the board of directors, and mergers with other credit unions.

Do credit unions help build credit?

Yes, credit unions can help you build credit. Many credit unions offer credit-building programs, such as share-secured loans or credit cards, that can help you establish or improve your credit score. Additionally, credit unions are typically willing to work with members with less-than-perfect credit, making it easier to get approved for loans and credit cards.

The right financial tools can help you get on the path to financial strength and stay there through all of life’s challenges. Leaders Credit Union supports their members by providing access to financial tools and guidance to their members achieve their most important financial goals.

Do credit unions have better interest rates?

In many cases, credit unions do offer better interest rates than banks. This is because credit unions are not-for-profit organizations that are owned by their members, so they are typically able to invest their profits to their members in the form of better rates on loan and higher return on saving and checking accounts. However, it's important to compare rates and fees from banks and credit union before making a decision.

Conclusion

In summary, credit unions and banks offer similar financial services, but there are some key differences between the two. Credit unions are not-for-profit organizations owned and operated by their members, while banks are for-profit institutions owned by shareholders. Credit unions often offer lower rates and fees, personalized customer service, and have membership requirements, while banks are open to anyone who meets their account opening requirements. Ultimately, choosing between a credit union and a bank depends on your personal financial needs and preferences.

Join Leaders Credit Union Today!

When you join a federally-insured credit union, you’ll have the peace of mind of knowing that your money is insured by the NCUSIF up to $250,000 per account and that you won’t risk losing your deposits in the unlikely event of a credit union failure. You’ll also be supporting your community and get access to financial tools and guidance to help you achieve your most important financial goals.

Do you live in West Tennessee? If so, you probably qualify to join Leaders Credit Union. Learn about our membership requirements and follow the steps in our guide to switching your primary checking account to make the transition with ease.