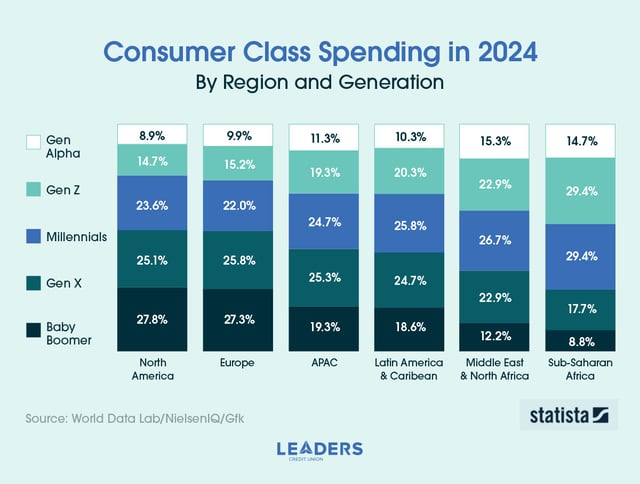

Welcome to your financial glow-up! You don’t need to be middle-aged to be smart with money, and you definitely don’t need to have it all figured out by 25. Whether you’re working your first job, dealing with student loans, splitting rent with roommates, or watching your favorite YouTube influencers “invest in crypto” on social media, one thing’s clear: money decisions in your 20s matter.

Here’s your starter pack: five essential financial moves every Gen Z adult should make before turning 25. These aren’t about being perfect. They’re about setting yourself up for wealth, not worry.

Money Move #1: Build a Budget That Works IRL

Budgeting isn’t about saying no to coffee. It’s about saying yes to self-control. Knowing where your money is going helps reduce stress, avoid overdraft fees, and make space for things you care about, whether that’s travel, new tech, or paying down debt.

Use Tech to Your Advantage

There are budgeting apps that connect to your accounts, automatically categorize expenses, and help you become a finance pro:

Try the 50/30/20 Rule

- 50% for needs (rent, groceries, bills)

- 30% for wants (fun stuff, subscriptions)

- 20% for saving and debt payments (emergency fund, student loans)

Why start before 25? Because the earlier you learn to manage your money, the more freedom you’ll have in the future.

Set spending limits and turn on alerts. Most banking apps let you know when you’re close to your limit. Your choices now will make a significant impact on your future financial well-being.

.jpg?width=640&height=263&name=Info-Graphic-montly-budget%20(1).jpg)

Money Move #2: Open the Right Bank Account

Not all bank accounts are created equal. Choosing the right one now can help you save time, avoid fees, and build better money habits.

What to Look for in Your First Bank Account:

- Free checking and savings (no minimums or monthly fees)

- Mobile features like remote check deposit, contactless payments, and bill pay

- Financial tools like credit score tracking or auto-saving

- Local support when you need it

Why a Credit Union Like Leaders Makes Sense:

Credit Unions are not-for-profit, which means fewer fees and more focus on you. Plus, our online banking gives you the convenience of big banks, with the service of a community-first institution.

Start with a checking account for spending and a savings account for goals. Connect them and set up automatic transfers to build your emergency fund effortlessly.

Money Move #3: Start Building Credit the Smart Way

Good credit = financial freedom later. Want to rent an apartment, buy a car, or qualify for lower interest on a loan? You’ll need a good credit score.

Here’s How to Build Credit Responsibly:

- Start with a secured credit card (you pay a deposit to “secure” it.)

- Use it for small purchases (like gas or groceries) and pay in full each month.

- Keep usage below 30% of your limit.

- Always pay on time; missed payments can tank your score.

Avoid These Traps:

- "Buy Now, Pay Later" apps can hurt your credit if you miss payments.

- Carrying a balance = paying interest. You don’t need to be in debt to build credit.

As soon as you’re earning enough to pay it off in full each month, you can open a card. Look for beginner-friendly cards with no annual fee and avoid store cards with high interest.

Money Move #4: Save Early, Even If It’s Just a Little

Think saving is boring? Think again. Starting early, even with just small amounts, can help you build serious momentum.

Compound interest = Your New BFF

Let’s say you save just $20/week starting at age 22 in a retirement account earning 7% interest. By age 65, you could have over $100,000, just from tiny weekly savings.

Easy Ways to Start:

- Use round-up tools that save your spare change automatically

- Set up auto-transfers to your savings account after every paycheck

- Open a Roth IRA (great for Gen Z because of flexible contributions and tax-free growth)

It's never too early to start saving. The earlier you start, the less you need to save later. Future you will be so glad you started now.

Money Move #5: Learn the Basics of Investing

Saving is great. But to grow wealth, you’ll want to start investing.

Don’t Chase TikTok Trends

Crypto? Meme stocks? MLMs? If it sounds too good to be true… it probably is. Start with the basics and work your way up, because any investment should be thought out before you move any money.

Safe Places to Start:

- Robo-advisors like Acorns or Betterment (set it and forget it)

- Micro-investing apps that let you invest with as little as $5

- Talk to your credit union about long-term options like IRAs or certificates

Do both investing and saving. Use savings for short-term goals and an emergency fund. Use investing for long-term growth, like retirement or a future down payment.

Your 20s Are for Learning. Let’s Get Started.

You don’t need to be perfect with money in your 20s, but you can start building habits that lead to real financial independence.

At Leaders Credit Union, we get that your financial life may look different from what your parents' did at your age. That’s why we offer:

- Easy mobile banking

- Starter checking and savings accounts

- Financial education tools to help you make confident money moves

- Personal investment services and resources like our guide, “Investing 101: A Guide to Growing Your Wealth”

- Local support when you have questions (or want to talk through your first credit card)

FAQs about First Money Moves

Q: Is budgeting really necessary if I don't make a lot of money?

A: Yes! Budgeting isn’t about how much you make, it’s about how you use it. Even a small income can go further when you know where every dollar is going. Budgeting = freedom, not restriction.

Q: How much should I save in my 20s?

A: Start with what you can—$10, $20, or even just your spare change. The key is consistency. Thanks to compound interest, small savings now can grow into big money later.

Q: What kind of bank account should I open first?

A: Look for a checking and savings account with no fees, mobile features, and helpful tools like automatic transfers or credit score tracking. Credit unions like Leaders Credit Union are a great place to start.

Q: Is investing risky? Should I wait?

A: All investing carries some risk, but starting small and early with the right tools can actually reduce risk over time. Stick to basics like robo-advisors or micro-investing apps and avoid trendy fads.

Leaders Credit Union is federally insured by the NCUA.