From buying a car to renting an apartment, being in your 20s comes with a lot of firsts. Whether you've just graduated college or have been in the workforce for a few years, having a strong financial foundation is essential for your well-being. Making wise financial decisions now will have impact on you for years to come, but you can't make wise decisions if you don't know what to do.

That's why our team at Leaders Credit Union is happy to help you learn what you need to know as you begin your financial journey. In this blog, find out 5 financial tips you might never have been taught before you began living on your own, and discover how you can apply them to your financial decisions.

Key Takeaways

- Build an emergency fund to save at least 3-6 months of expenses.

- Use the debt snowball method or debt avalanche method to pay off any debt as soon as possible.

- Having a credit card doesn't have to be scary; it's all about how you use it and your financial habits.

- Begin investing for your retirement by opening a Roth IRA or Roth 401(k) investment account.

1. Have a Financially Independent Mindset

One of the most misleading things you could fall for in your 20s is that you'll start a high-paying job right out of college or trade school. While you might be in a high-paying field, that doesn't guarantee you'll be receiving the highest paying salary right away. Being financially independent for the first time comes with a lot of learning curves. It can be an adjustment to go from having your needs met to having to manage it all on your own.

Your lifestyle won't look like your parents. Aging out of your parent's house, you might have been used to a larger living space, shared meals, going on family vacations, or going out to eat regularly. Now that you're on your own, you'll have to adjust your lifestyle to "live within your means." This means some activities that might be financially affordable to others, like your parents or guardians, might not be the wisest choice for you.

As you shift to a financially independent mindset, you'll start to be aware of expenses you never had to consider before. Sure, you might be aware of essentials like paying for gas or rent, but smaller expenses can add up quickly, such as renter's insurance, car maintenance, etc. While being in your 20s is an exciting season, it's key that you know what to expect, so you can be financially healthy now to have a financially healthy future.

2. Build an Emergency Fund

Starting out your finances on your own can be overwhelming when deciding where to begin. The first step to building a strong financial foundation is to start an emergency fund. Emergency funds are savings accounts that you hold onto in case of an unexpected expense, such as a medical bill from a trip to the emergency room or suddenly losing your job.

It's recommended to have at least 3-6 months of living expenses saved, and the exact amount can vary depending on if you're single, married, or have children. To begin, start small: set aside some money each month and put it in a high-yield savings account, so you can earn interest while you save.

3. Be Diligent in Paying Off Debt

Now that you have your degree, you're responsible for paying off any student loans you may have and keeping track of your monthly payments. If you've never had any debt prior to school, it can be a challenge to keep up with payments. Paying off debt is a skill you'll need to develop.

As you pay off your student loans, don't just settle for paying the minimum amount you are required to pay. Put your total amount of debt you owe in a goal tracker to see the time you're estimated to have it paid off by. You might realize it will take many years to pay off your debt if you keep at the same pace. Paying off debt for decades likely isn't your ideal financial plan.

Remember, the goal you should have is to be out of debt as soon as possible. This doesn’t mean you should completely drain your entire savings account to pay it off instantly—rather, it’s the intentional choice to prioritize your finances by diligently paying off debt each month instead of recklessly spending on items you don’t need.

With debt, here are two strategies you could utilize for paying off your student loans:

Debt Snowball

Strategy: Pay off loans from smallest to largest

You can envision this as a snowball that goes down a hill: the snowball might seem small at first, but as it rolls down, it gains momentum and becomes larger. The same idea goes with your debts as you faithfully pay them off.

Debt Avalanche

Strategy: Pay off loans with the highest interest first, then the lowest

By choosing this method, you could avoid having to pay even more than you already owe in the long run by avoiding extra interest.

4. Credit Cards Aren't Always Your Enemy

Depending on your experience and financial education, you might be apprehensive about using credit cards. The dangers of using a credit card are truly dependent on the individual using one. For some, using a credit card makes it easy for impulsive spending, which can be a threat to their financial health by risking the chance of accumulating credit card debt.

For others, credit cards can be a useful way to build good credit and even protect your money. Paying your card payments on time and in full instead of just the minimum requirement shows lenders you're on top of things by being responsible with your spending and keeping yourself out of unnecessary debt. Another benefit to using a credit card is that you could earn cash back or rewards as you spend, maximizing your spending decisions.

Using a credit card can also protect you from fraud. While fraud can happen on either credit or debit cards, it's typically safer using a credit card for online purchases since it's a line of credit and not directly tied to your bank account like your debit card.

5. Invest Early for Retirement

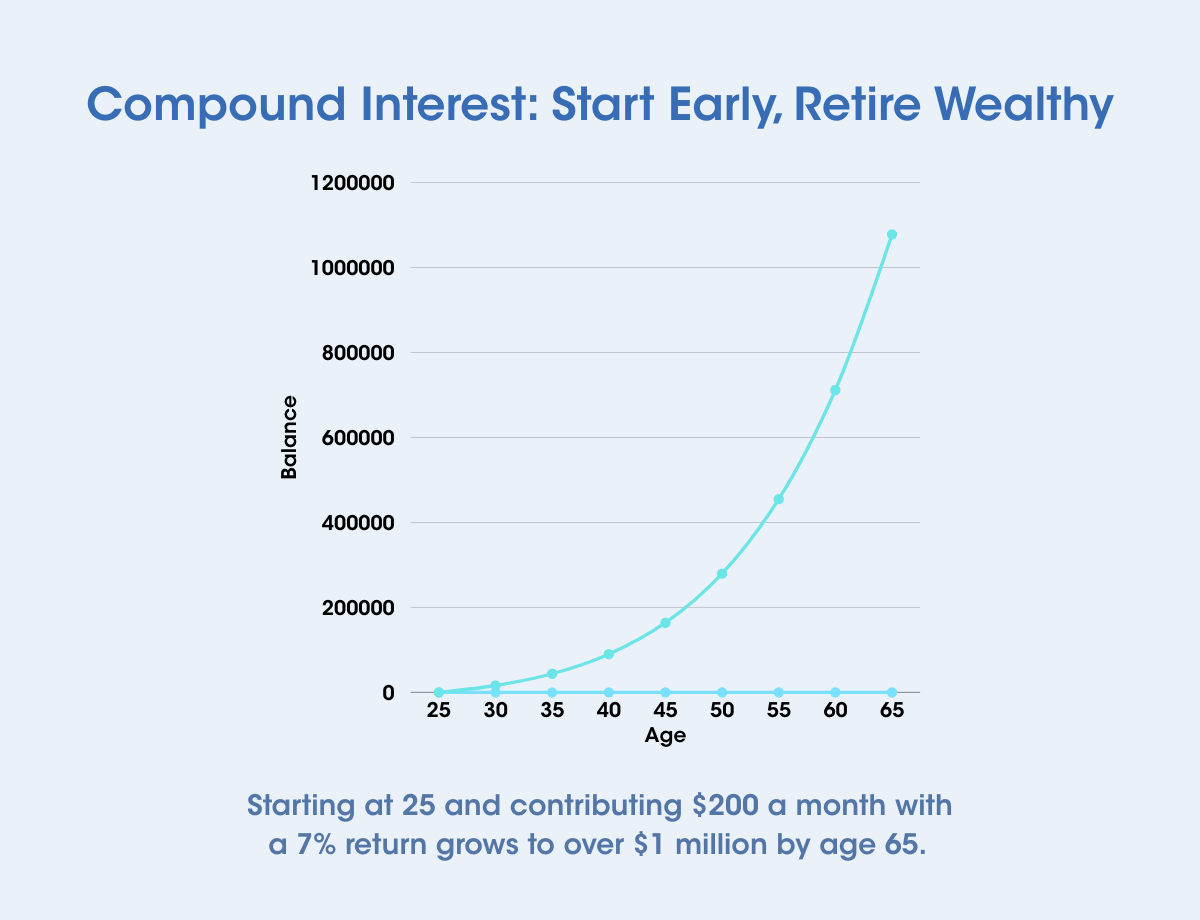

If you're in your early 20s, retirement is probably one of the last things on your mind. Why worry about something that's decades away? Well, you might be surprised what a significant impact your choices now can have on your future.

Investing early is one of the best ways to take advantage of compound interest, meaning you earn interest on both what you contribute and the interest that builds over time. Starting young also gives you access to powerful retirement-saving tools. Two of the most common options are a 401(k), which is offered through your employer, and an IRA, which you can open on your own if your employer doesn’t provide a retirement plan. Both offer tax advantages that help your money grow more efficiently for the future.

While there's a lot of different routes you can go for your retirement plan, the best one for your age would be a Roth IRA or Roth 401(k). This account allows your money to grow tax-free, which is great for years down the road.

FAQs about Financial Literacy in Your 20s

Q: How much should I keep in an emergency fund?

A: Aim to keep at least 3-6 months of living expenses saved in a high-yield savings account, so your money can grow while you save.

Q: How do I pay off my student loans fast?

A: There are two different strategies you can use to pay off debt: the debt snowball method or the avalanche method. The debt snowball method is when you pay off your student loans smallest to greatest, and the debt avalanche is when you pay off your debts with the highest interest first. Either one of these methods can work well for quickly paying off student loans.

Q: What's the difference between a 401(k) and an IRA?

A: A 401(k) is an employer-sponsored retirement plan that you contribute to through work, while an IRA is an individual retirement account you set up on your own through a bank or financial institution. Both help you save for the future, but they differ in who provides them and how much you can contribute each year.

Q: What type of investment account should I have for retirement?

A: For young adults in their 20s, it's recommended to have a Roth 401(k) and/or a Roth IRA to take advantage of compound interest and allow your money to grow tax-free.

Grow Your Financial Literacy with Leaders Credit Union

Are you in your early 20s and struggling to manage your finances? Learning how to be financially independent and to make wise financial decisions can be a challenge, but you don't have to face this learning curve alone. Our Financial Champions are happy to help you as you begin your financial journey. We also have in-person financial counseling, if you want to meet with one of our Financial Champions to have a personal conversation about your financial plan.

Want more information for how to make wise financial decisions? Read our blog, "The Gen Z Starter Pack: 5 Money Moves to Make Before 25."

Deepen your understanding of how to manage your money with our free Gen Z Guide to Grown-Up Money Decisions.

Leaders is federally insured by the NCUA.